Auto Loans vs. Leasing: The dream of a new car is often accompanied by the looming question of how to pay for it. For most, this boils down to two primary options: an auto loan or a lease. Both pathways lead to the driver’s seat, but they diverge significantly when it comes to long-term costs, flexibility, and overall financial impact. Understanding the nuances of each is crucial to making an informed decision that truly saves you money in the long run. This comprehensive guide will dissect auto loans and leasing, examining their pros and cons, hidden costs, and scenarios where one might be more advantageous than the other.

The Allure of a New Ride: Initial Considerations

Before diving into the specifics of loans and leases, it’s essential to first define your automotive needs and financial situation. Ask yourself:

- How long do you typically keep a car? Do you prefer to drive a new model every few years, or are you the type to hold onto a vehicle for a decade or more?

- What’s your monthly budget for a car payment? Be realistic about what you can comfortably afford, factoring in not just the car payment but also insurance, fuel, and maintenance.

- How many miles do you drive annually? This is a critical factor for leasing, as mileage restrictions can lead to hefty penalties.

- What’s your credit score like? A higher credit score generally translates to better interest rates on loans and more favorable lease terms.

- Do you want to own the vehicle outright eventually? This is a fundamental difference between loans and leases.

- How important is having the latest technology and safety features?

- What is your financial stability? Unexpected job changes or financial setbacks can impact your ability to meet long-term commitments.

Having a clear understanding of these points will provide a solid foundation for evaluating which financing option aligns best with your lifestyle and financial goals.

Auto Loans: The Path to Ownership

An auto loan is a traditional financing method where a lender provides you with a lump sum to purchase a vehicle. You then repay this amount, plus interest, over a predetermined period, typically ranging from 24 to 84 months. At the end of the loan term, once all payments are made, you own the car free and clear.

The Mechanics of an Auto Loan:

- Principal: The actual amount of money you borrow to buy the car.

- Interest Rate (APR – Annual Percentage Rate): The cost of borrowing money, expressed as a percentage. This significantly impacts your total cost.

- Loan Term: The duration over which you will repay the loan. Longer terms often mean lower monthly payments but higher total interest paid.

- Down Payment: An upfront sum of money you pay towards the purchase price of the car. A larger down payment reduces the amount you need to borrow, thus lowering your monthly payments and total interest.

- Trade-in: If you have an existing car, its value can be applied as a down payment.

Advantages of Auto Loans:

- Ownership and Equity: The most significant advantage is that you eventually own the vehicle. This means you can sell it, trade it in, or keep it as long as you wish. As you pay down the loan, you build equity in the car, which can be a valuable asset.

- No Mileage Restrictions: Drive as much as you want without fear of incurring overage charges. This is ideal for commuters, road-trippers, or those with unpredictable travel needs.

- Customization Freedom: Since you own the car, you’re free to customize it with aftermarket parts, paint jobs, or any modifications you desire without impacting its resale value (though some modifications might void warranties).

- No Wear and Tear Penalties: While it’s always wise to maintain your vehicle, you won’t face penalties for “excessive” wear and tear at the end of the loan term, unlike a lease.

- Long-Term Savings (Potentially): Once the loan is paid off, you eliminate a significant monthly expense. The longer you keep the car after it’s paid off, the more money you save compared to perpetually making car payments.

- Flexibility in Selling or Trading: You can sell or trade in your car at any point, even if you still owe money on the loan. The equity you’ve built can contribute to your next vehicle purchase.

- Opportunity to Refinance: If interest rates drop or your credit score improves, you might be able to refinance your loan for a lower interest rate, reducing your monthly payments or total interest.

Disadvantages of Auto Loans:

- Higher Monthly Payments (Initially): Compared to leases for similar vehicles, loan payments can be higher, especially with shorter terms.

- Depreciation Risk: You bear the full brunt of depreciation, which is the loss of value a car experiences over time. Cars lose a significant portion of their value in the first few years.

- Maintenance Responsibility: As the owner, all maintenance and repair costs, especially after the warranty expires, fall solely on you.

- Hassle of Selling: When it’s time for a new car, you’re responsible for selling your current one, which can be time-consuming and involve negotiations.

- Potentially Higher Upfront Costs: A substantial down payment is often recommended to secure better terms and reduce the overall cost of the loan.

When an Auto Loan Makes Sense:

- You plan to keep your car for many years, ideally past the loan term.

- You drive a high number of miles annually.

- You want the freedom to customize your vehicle.

- You value ownership and building equity.

- You have a good down payment available.

- You prefer predictable, fixed payments and eventually no car payment at all.

Leasing: The Path to Temporary Access

Leasing is essentially a long-term rental agreement. You pay to use a vehicle for a set period, usually 24 to 48 months, and then return it to the dealership at the end of the term. You never own the car; you’re simply paying for its depreciation during the time you’re driving it, plus interest (known as the money factor).

The Mechanics of a Car Lease:

- Capitalized Cost (Cap Cost): This is essentially the selling price of the car in a lease. Lowering the cap cost through negotiations or a down payment (called a “cap cost reduction”) will lower your monthly payments.

- Residual Value: The estimated value of the car at the end of the lease term. This is determined by the leasing company and is a critical factor in your monthly payments. A higher residual value means lower monthly payments.

- Money Factor: This is the interest rate equivalent in a lease. It’s usually expressed as a small decimal (e.g., 0.0025) and needs to be multiplied by 2400 to get an approximate APR.

- Lease Term: The duration of the lease agreement.

- Mileage Allowance: A specified limit on how many miles you can drive annually (e.g., 10,000, 12,000, or 15,000 miles). Exceeding this limit results in per-mile penalties.

- Wear and Tear Guidelines: Specific rules about what constitutes “acceptable” wear and tear on the vehicle. Damage beyond this can result in charges.

Advantages of Leasing:

- Lower Monthly Payments: For comparable vehicles and terms, lease payments are almost always lower than loan payments because you’re only paying for the depreciation, not the entire purchase price.

- Drive New Cars More Frequently: Leasing allows you to get into a new vehicle every few years, giving you access to the latest technology, safety features, and styling.

- Always Under Warranty: Since lease terms are typically short, your leased vehicle is usually covered by the manufacturer’s warranty for the entire duration, minimizing unexpected repair costs.

- Lower Upfront Costs (Potentially): Leases often require less money down than loans, making them more accessible for some individuals.

- Hassle-Free Trade-in/Sale: At the end of the lease, you simply return the car to the dealership. There’s no need to worry about selling it or negotiating a trade-in value.

- Tax Advantages for Businesses: For businesses, lease payments can often be tax-deductible as an operating expense.

Disadvantages of Leasing:

- No Ownership or Equity: You never own the car and therefore build no equity. This means you have no asset to sell or trade in at the end of the lease.

- Mileage Restrictions and Penalties: This is often the biggest drawback. Exceeding your agreed-upon mileage can lead to significant charges (e.g., $0.15 to $0.30 per mile).

- Wear and Tear Penalties: If the car has excessive dents, scratches, stained upholstery, or other damage beyond “normal wear and tear,” you’ll face additional charges at lease end.

- Early Termination Fees: Getting out of a lease early is usually very expensive, often requiring you to pay the remaining payments and other fees. This makes leases much less flexible than loans.

- Higher Total Cost (Potentially): While monthly payments are lower, if you continuously lease new cars every few years, you’ll perpetually have a car payment and may end up paying more over the long term than if you had bought and kept a vehicle.

- No Customization: Modifying a leased car is generally not allowed, as it can impact the car’s residual value.

- Insurance Requirements: Leasing companies often require higher insurance coverage (e.g., higher liability limits, gap insurance) to protect their asset.

When Leasing Makes Sense:

- You enjoy driving a new car every 2-4 years.

- You drive a consistent, low number of miles annually.

- You want lower monthly payments.

- You prefer staying under warranty coverage.

- You don’t want the hassle of selling or trading in a car.

- You value having the latest technology and safety features.

- You’re a business owner seeking potential tax advantages.

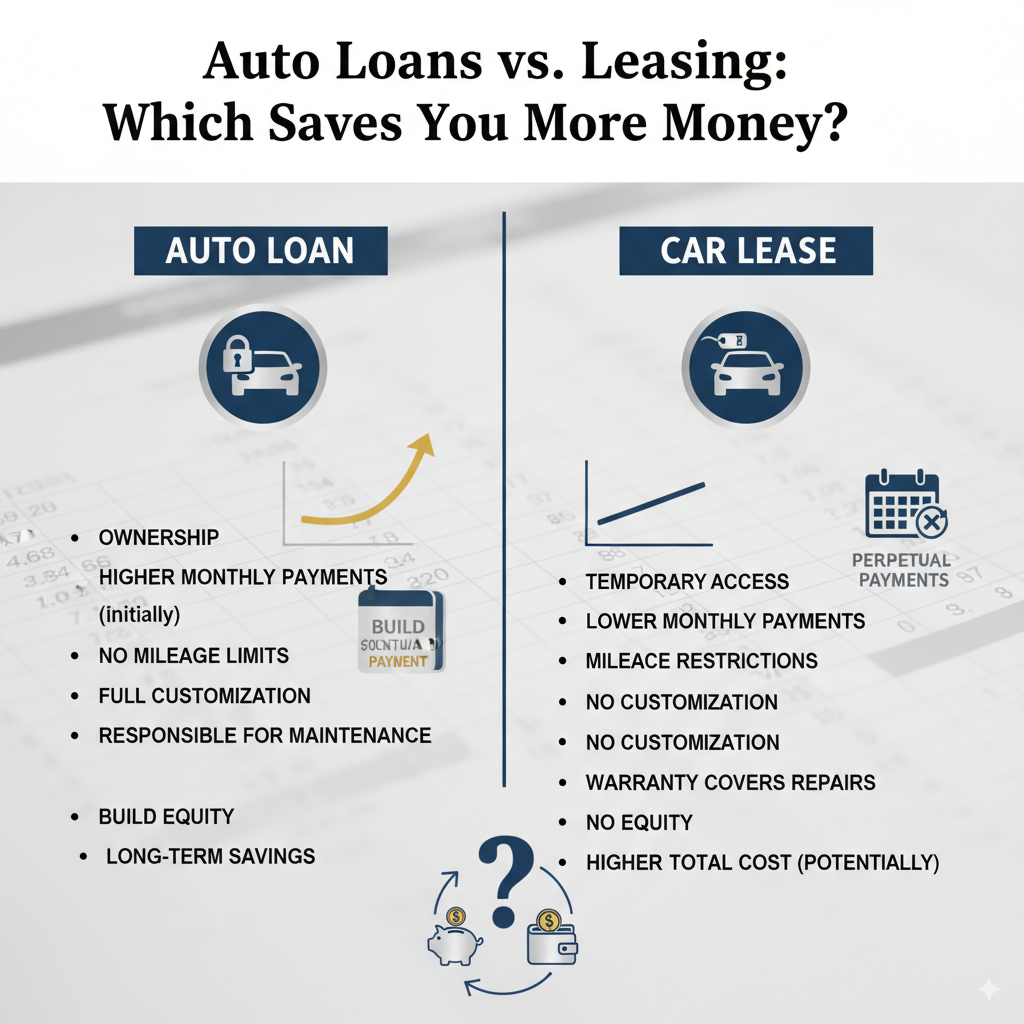

Side-by-Side Comparison: Loan vs. Lease

Let’s break down the key differences to highlight where your money goes with each option:

| Feature | Auto Loan | Lease |

| Ownership | You own the car once paid off. | You never own the car; it’s a long-term rental. |

| Monthly Payments | Generally higher, especially initially. | Generally lower. |

| Total Cost Over Time | Potentially lower if you keep the car long-term. | Potentially higher if you continuously lease. |

| Down Payment | Often recommended, reduces total interest. | Often optional, reduces monthly payment (cap cost reduction). |

| Mileage | Unlimited. | Restricted, with penalties for overage. |

| Wear and Tear | Your responsibility, no end-of-term penalties. | Subject to strict guidelines, penalties for excess. |

| Customization | Full freedom. | Generally not allowed. |

| Maintenance | Your full responsibility (after warranty). | Typically covered by warranty during the lease term. |

| Equity | Build equity as you pay down the loan. | No equity built. |

| End of Term | You own the car; can sell, trade, or keep. | Return the car, or you may have an option to buy it. |

| Flexibility | More flexible for early sale/trade. | Very expensive to terminate early. |

| Depreciation | You bear the full cost of depreciation. | You pay for the depreciation during the lease term. |

Hidden Costs and Factors to Consider

Both loans and leases come with additional costs beyond the advertised monthly payment. Being aware of these can prevent unpleasant surprises.

Hidden Costs of Auto Loans:

- Interest: This is the primary “hidden” cost. A small difference in APR can add thousands to your total cost over the life of the loan. Shop around for the best rates.

- Sales Tax: You’ll typically pay sales tax on the full purchase price of the vehicle upfront or rolled into the loan.

- Documentation Fees: Dealerships charge various administrative fees for processing paperwork.

- Registration and Licensing Fees: Annual costs for vehicle registration and license plates.

- Maintenance and Repairs: After the warranty expires, all repairs are your responsibility. This can include major components like engines, transmissions, or expensive electronics.

- Increased Insurance Premiums: Newer, more expensive cars generally have higher insurance costs.

- Gap Insurance (Optional but Recommended): If your car is totaled or stolen and you owe more than its market value, gap insurance covers the difference. While optional, it can save you from being upside down on your loan.

Hidden Costs of Leasing:

- Money Factor (Interest): Just like loans, leases have an interest component. Don’t overlook this when comparing deals.

- Acquisition Fee: A fee charged by the leasing company for setting up the lease.

- Disposition Fee: A fee charged at the end of the lease for cleaning and processing the vehicle’s return.

- Sales Tax (on Payments): In most states, you pay sales tax only on the monthly lease payments, not the full vehicle price.

- Mileage Penalties: The most common “hidden” cost. If you drive more than your allowance, these can quickly add up.

- Excess Wear and Tear Charges: Dings, dents, scratches, torn upholstery, or even certain tire wear can result in fees.

- Early Termination Fees: If you need to break the lease early due to unforeseen circumstances, the penalties are usually substantial.

- Higher Insurance Requirements: Leasing companies often mandate higher liability limits and require gap insurance to protect their asset.

- Overdue Payment Penalties: Late fees and potential damage to your credit score if payments are missed.

The “Saves You More Money” Question: A Deeper Dive

The answer to which option saves you more money is not black and white; it depends heavily on your individual circumstances and habits.

When an Auto Loan Saves You Money:

- Long-Term Ownership: If you plan to keep your car for 5+ years, especially after the loan is paid off, buying almost always saves you more. You eliminate car payments and continue to drive a depreciating asset for free, minus maintenance.

- High Mileage Drivers: For those who drive significantly, loans are the clear winner. Avoiding mileage penalties can save you thousands.

- Low Depreciation Vehicles: If you purchase a car known for holding its value well, you’ll incur less depreciation, making the ownership cost more favorable.

- Disciplined Savers: If you can consistently save for a large down payment, you’ll reduce your borrowing costs substantially.

Example Scenario (Loan):

- Car Price: $30,000

- Down Payment: $5,000

- Loan Amount: $25,000

- Interest Rate: 5% APR

- Term: 60 months

- Monthly Payment: ~$472

- Total Interest Paid: ~$3,320

- Total Cost (over 5 years, excluding maintenance, fuel, insurance): $30,000 + $3,320 = $33,320.

- If you keep the car for another 5 years after paying it off, your “car payment” drops to $0, significantly reducing your long-term cost of ownership.

When Leasing Saves You Money (or at least feels like it does):

- Short-Term New Car Access: If you crave a new car every 2-4 years, leasing can offer lower monthly payments to access those newer models. The convenience of always driving a new, warrantied car with the latest tech has a value, even if it doesn’t build equity.

- Low Mileage Drivers: If you consistently drive well under the mileage allowance, you won’t incur penalties, making the lease more predictable.

- Predictable Maintenance: For the term of the lease, most major repairs are covered by warranty, offering peace of mind and predictable running costs (excluding routine maintenance like oil changes).

- Businesses: The potential tax deductions for lease payments can offer real savings for companies.

Example Scenario (Lease):

- Car Price (Cap Cost): $30,000

- Residual Value (after 36 months): $18,000

- Depreciation Paid: $12,000

- Money Factor: 0.0015 (approx. 3.6% APR)

- Term: 36 months

- Monthly Payment (approx., excluding taxes/fees): ~$350

- Total Paid (over 36 months, excluding taxes/fees, no penalties): $350 x 36 = $12,600.

- At the end, you have no car and need to lease or buy another, restarting payments.

Comparing the Examples:

In the short term (3-5 years), the lease has lower monthly payments and a lower total outlay. However, after the loan is paid off, the “car payment” becomes $0 for the owner. If the owner keeps the car for, say, 10 years, their total cost of ownership will likely be significantly lower than someone who leases two or three cars over the same decade. The lease scenario ensures you always have a car payment.

The “Opportunity Cost” Factor:

Consider what you could do with the money saved on lower lease payments. If you invest the difference wisely, those savings could potentially grow into a significant sum, offsetting the lack of equity in a leased vehicle. However, this requires financial discipline.

The Hybrid Option: Lease-to-Own

Some leases offer a “lease-to-own” or “purchase option” clause. At the end of the lease term, you have the option to buy the vehicle for its residual value (plus any purchase option fees). This can be a good option if you genuinely love the car and it has been well-maintained with low mileage. However, always compare the purchase option price to the car’s current market value to ensure you’re getting a fair deal. Often, the residual value is set high by the leasing company, making the buyout less attractive than simply finding a similar used car.

Key Factors to Maximize Savings Regardless of Choice

No matter whether you loan or lease, certain principles apply to saving money:

- Shop Around: Get quotes from multiple dealerships, banks, credit unions, and online lenders. Interest rates and lease terms can vary wildly.

- Negotiate: Don’t accept the first offer. Negotiate the vehicle’s price (for a loan) or the capitalized cost (for a lease). Every dollar saved upfront translates to less interest paid.

- Boost Your Credit Score: A higher credit score (typically 700+) will unlock the best interest rates and lease terms.

- Consider Used Cars (for Loans): Used cars have already undergone the steepest part of their depreciation curve, making them a potentially more cost-effective purchase than a new vehicle.

- Read the Fine Print: Understand all fees, terms, and conditions before signing any agreement. Pay close attention to mileage limits, wear and tear clauses, and early termination penalties.

- Budget for ALL Costs: Don’t just focus on the car payment. Factor in insurance, fuel, maintenance, registration, and potential unexpected repairs.

- Avoid Unnecessary Add-ons: Resist pressure to buy extended warranties, paint protection, or other costly extras unless you genuinely need and understand their value.

Conclusion: Making the Right Decision for YOU

There’s no universal answer to whether an auto loan or lease saves you more money. It’s a highly personal decision driven by your financial situation, driving habits, and automotive preferences.

- Choose an Auto Loan if: You prioritize ownership, plan to keep your vehicle for many years, drive extensively, and want the freedom to customize. You’re willing to take on the responsibility of maintenance and depreciation for the long-term benefit of no car payments.

- Choose a Lease if: You prefer driving a new car every few years, have consistently low mileage, value lower monthly payments, and appreciate having your vehicle under warranty for most of its time with you. You’re comfortable with not owning the asset and adhering to specific terms.

Before making a commitment, perform a thorough cost analysis. Calculate the total cost of ownership for both a loan and a lease over your expected driving period, including all fees, interest, potential penalties, and estimated maintenance. Talk to financial advisors and car sales professionals, but ultimately, the decision should align with your personal financial goals and lifestyle. By understanding the intricate details of auto loans and leasing, you can confidently choose the option that truly puts more money back in your pocket.