Insurance of Works in Construction; The purpose of Contract Works insurance is to cover building works in progress, should loss or damage occur during construction.

A Tale of Two Projects

Imagine two construction projects, both poised to reshape a city’s skyline.

Project Atlas is a marvel of planning. The developer, a seasoned professional, has every detail mapped out: blueprints certified, materials sourced, and a top-tier general contractor, “Titan Builders,” ready to break ground. Titan has their standard insurance—General Liability to cover accidents, Commercial Auto for their fleet, and Workers’ Comp for their crew. They feel prepared.

Project Phoenix is identical in scope and ambition. The owner, equally meticulous, has also hired a stellar contractor, “Aegis Construction.” But before the first shovel hits the dirt, the owner and Aegis’s risk manager sit down with an insurance broker who specializes in construction. They don’t just talk about liability; they talk about the work itself. They put in place a comprehensive “Contractor’s All Risks” policy, a specialized insurance designed to protect the project from the ground up.

Six months in, disaster strikes both sites. A freak microburst, a sudden and violent storm, tears through the district.

At Project Atlas, the half-erected steel frame, valued at $4 million, is twisted and warped by the extreme winds. A massive crane topples, crashing into the structure. The site is a wreck. Titan Builders calls their General Liability insurer, only to be told the devastating news: “We’re sorry, but your policy covers damage you cause to other people’s property. It doesn’t cover damage to your own work in progress.” The project grinds to a halt, buried in lawsuits between the developer and the contractor over who is responsible for the loss. Lenders pull their financing. Project Atlas becomes a cautionary tale—a rusted skeleton on the horizon.

At Project Phoenix, the storm causes identical damage. But the morning after, the call to their insurer is different. A loss adjuster is on-site within 48 hours. The Contractor’s All Risks policy springs to life. It covers the cost to remove the debris. It pays for the new steel and the rental of a new crane. It even covers the overtime needed to get the project back on schedule. While a setback, it’s not a catastrophe. Project Phoenix rises from its own near-ashes, its future secured by a policy its competitor overlooked.

This tale isn’t fiction; it’s a reality played out on construction sites worldwide. The difference between success and failure often comes down to understanding one critical concept: the Insurance of Works. This guide is your definitive blueprint to mastering it.

Part 1: The Foundation – Why Your Standard Insurance Isn’t Enough

Many contractors, especially those new to large-scale projects, fundamentally misunderstand the scope of their basic insurance. They assume their General Liability (GL) policy is a catch-all for anything that goes wrong. This is a dangerous and costly assumption.

The Critical Distinction: Liability vs. Property

To understand Insurance of Works, you must first grasp the two fundamental pillars of risk in construction:

- Liability Risk: This is the risk of your operations causing bodily injury or property damage to a third party. Your General Liability policy is designed specifically for this.

- Example: Your welder accidentally sets fire to an adjacent, occupied building. Your GL policy covers the damage to that neighboring property.

- Example: A visitor to the site trips over your materials and breaks their leg. Your GL policy covers their medical bills and any subsequent lawsuit.

- Property Risk (The Work Itself): This is the risk of damage to the very thing you are building—the structure, the materials, the equipment on-site. It’s your work, your project. Fire, theft, wind, vandalism, or collapse can wipe out millions of dollars of value in minutes. Your General Liability policy explicitly excludes this.

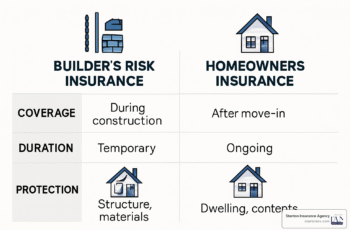

Insurance of Works is a specialized form of property insurance designed to fill this massive gap. It treats the project under construction as the insured property. It’s often called Builder’s Risk Insurance or Contractor’s All Risks (CAR) Insurance. Its sole purpose is to protect the financial investment in the labor and materials from physical loss or damage during the course of construction.

Who Is at Risk? The Stakeholders

A loss on a construction project doesn’t just affect the contractor. The financial shockwaves ripple outwards, impacting everyone involved:

- The Project Owner/Developer: They have the most to lose. They’ve invested capital and secured financing based on the project being completed. A major loss could bankrupt their entire venture.

- The General Contractor: They are contractually obligated to deliver the project. A loss could mean they have to rebuild a portion of the work at their own expense, leading to financial ruin.

- The Lenders/Financiers: Banks and investors who provide loans for the project have a vested interest. Their collateral is the project itself. They will not release funds without proof that this type of insurance is in place.

- Subcontractors: They have labor and materials invested in the project. If a fire destroys the site, their work is gone, and payment disputes are almost guaranteed.

Insurance of Works is the contractual and financial glue that holds all these interests together, ensuring that if a physical loss occurs, there is a dedicated pool of money to make everyone whole and, most importantly, get the project finished.

Part 2: The Core Policies – Your Shield for the Build

While the names can vary by region (Builder’s Risk is more common in the U.S., while Contractor’s All Risks is a global standard), the intent is the same. Let’s dissect the most comprehensive form: the Contractor’s All Risks (CAR) Policy.

A CAR policy is the master policy for a construction site. It’s a package policy that typically combines two major sections into one.

Section I: Material Damage — Protecting the Physical Asset

This is the heart of the policy. It protects against physical loss or damage to the works in progress. The key feature is that it’s written on an “All Risks” basis.

This doesn’t mean it covers literally everything. It means the policy covers damage from any cause (or “peril”) that is not specifically excluded. This is much broader than a “Named Perils” policy that only covers a specific list of events.

What Property is Covered?

- The Contract Works: This includes the permanent structure being built (the building, the bridge, the road) and any temporary works necessary for construction (scaffolding, formwork, access roads).

- Materials on Site: Any materials, from foundation rebar to finishing fixtures, that are on the construction site waiting to be incorporated into the project.

- Materials in Transit or Storage (with endorsement): Often, coverage can be extended to cover materials while they are being transported to the site or stored at a temporary off-site location.

What Perils are Typically Covered?

Because it’s “All Risks,” it’s easier to think of what’s excluded. But common covered events include:

- Fire, Lightning, Explosion: The most common and often most devastating risks.

- Theft and Vandalism: Construction sites are prime targets for theft of copper wiring, expensive tools, and high-value materials.

- Weather Events: Storm, wind, flood, hail, and water damage from rain entering an incomplete structure.

- Collapse: Structural collapse due to a covered peril.

- Accidents during Construction: Damage caused by vehicle impacts, crane failures, or other construction-related mishaps.

What are the Common Exclusions? (This is CRITICAL to understand)

“All Risks” has its limits. Every policy contains exclusions. Reading and understanding them is paramount.

- Faulty Design, Planning, Workmanship, or Materials: Standard CAR policies will cover the resulting damage from a fault, but not the cost to fix the faulty part itself. (e.g., If a poorly designed beam fails and causes a roof to collapse, the policy covers the collapsed roof but not the cost of redesigning and replacing the beam itself. This can be bought back with a special endorsement, see Part 3).

- Willful Misconduct or Gross Negligence: You can’t intentionally damage the property and expect a payout.

- War, Terrorism, and Nuclear Risks: These are typically covered by separate, specialized policies.

- Wear and Tear, Corrosion, Rust: Gradual deterioration is a maintenance issue, not an insurable event.

- Cessation of Work: If the project is abandoned for a long period (e.g., 60-90 days), coverage may cease.

- Penalties for Delay: The policy covers the cost to repair physical damage; it does not cover financial losses from project delays (Liquidated Damages), unless a special extension is purchased.

Real-World Scenario: Material Damage

A new five-story office building is 70% complete. Overnight, thieves break into the site, vandalize the drywall, and steal all the copper plumbing and electrical wiring that has been installed, causing over $250,000 in damage and replacement costs. The CAR policy’s Section I would respond, covering the cost to replace the stolen materials and repair the vandalism, allowing the contractor to get back on track.

Section II: Third-Party Liability — Protecting the Public

While the contractor should already have a separate annual General Liability policy, the CAR policy often includes its own liability section. This is crucial because it is project-specific. It provides a dedicated limit of liability just for claims arising from that particular construction site.

What Does It Cover?

It covers the insured’s legal liability for accidental bodily injury or property damage to third parties that arises directly from the construction activities on the insured site.

- A “third party” is anyone who is not directly involved in the construction project (e.g., the general public, visitors, owners of adjacent properties).

- “Bodily injury” includes sickness, disease, and death.

- “Property damage” means physical damage to tangible property.

How is this different from a standard General Liability policy?

- Project-Specific Limit: A major accident on one site won’t exhaust the liability limits the contractor needs for their other ongoing projects.

- Owner Protection: It can be structured to protect the project owner as well as the contractor under the same policy, preventing disputes.

- Fewer Gaps: It’s tailored to construction risks, sometimes covering things a standard GL policy might have exclusions for in a construction context, like collapse or vibration damage to nearby properties.

Real-World Scenario: Third-Party Liability

During the excavation phase of a downtown high-rise, the vibrations from pile driving cause deep cracks to form in the foundation of the historic building next door. The owner of the neighboring building sues the project for $1.2 million in structural repair costs. The CAR policy’s Section II would respond to this claim, covering the legal defense costs and the final settlement for the damage to the third-party property.

Erection All Risks (EAR) Insurance

A close cousin to the CAR policy is the Erection All Risks (EAR) policy. While they are similar, an EAR policy is specifically designed for projects where the primary value is in the erection of machinery, plant, and steel structures.

- Think: Power plants, manufacturing facilities, telecommunication towers, oil and gas infrastructure.

- Key Difference: An EAR policy places a greater emphasis on testing and commissioning. It covers the risk of loss during the critical phase when the machinery is first turned on and tested, a period with unique risks of electrical and mechanical breakdown.

For most commercial and residential building projects, a CAR/Builder’s Risk policy is the correct choice. For industrial or heavy machinery projects, an EAR policy is more appropriate.

Part 3: Essential Extensions & Endorsements – Customizing Your Armor

A standard, off-the-shelf CAR policy is a good start, but a construction project has unique needs. Insurance policies can be customized with extensions or endorsements that add back coverage for certain risks. A knowledgeable broker is essential for negotiating these.

Here are some of the most critical extensions for any major construction project:

- Design-Exclusion Amendments (DE/LEG Clauses): This is arguably the most important and complex endorsement. As mentioned, a standard policy excludes cover for faulty design. A “DE” (Defective Design) or “LEG” (London Engineering Group) endorsement modifies this exclusion. They come in different levels:

- DE/LEG 1: The most basic. Doesn’t really add coverage.

- DE/LEG 2: Covers the resulting damage from the faulty part. (This is often the default in good policies).

- DE/LEG 3: Covers the resulting damage and the cost to replace the other non-faulty parts of the structure that have to be removed to fix the faulty part.

- DE/LEG 4 & 5: The broadest forms, which can cover the cost of rectifying the faulty part itself. These are expensive and harder to obtain.

- Why it matters: Without this, a simple design flaw could lead to an enormous uninsured loss.

- Removal of Debris: After a loss, the cost to clear the site of debris from the damaged property can be substantial. This extension provides a specific, separate limit for those costs, so it doesn’t erode the main limit needed for rebuilding.

- Expediting Expenses (or Sue and Labour): Covers the extra costs needed to speed up repairs and get the project back on schedule after a covered loss. This can include things like overtime for labor, express freight for materials, or air travel for specialists.

- Off-Site Storage and Transit: A standard policy only covers materials once they arrive at the job site. This extends coverage to a specified off-site warehouse or while the materials are in transit to the site. This is critical for projects using expensive, custom-made components like prefabricated modules or specialized glazing.

- Maintenance Period / Defects Liability Period Cover: A CAR policy typically ends when the project is handed over to the owner. However, the contractor is often responsible for a “defects liability period” (e.g., 12 or 24 months) to fix any issues that arise. This extension can provide limited coverage during that period for damage caused by the contractor while on site performing maintenance obligations. A broader form, “Extended Maintenance,” can even cover damage resulting from a fault during construction that only manifests during the maintenance period.

- Vibration and Removal/Weakening of Support: Excavation, piling, and other construction activities can cause damage (like cracking or subsidence) to nearby properties. This extension ensures coverage for liability claims from such damage, which is sometimes excluded in standard policies.

Part 4: The Practicalities – Who, When, and How Much?

Understanding the policy is one thing. Implementing it effectively is another.

Who Buys the Policy? OCIPs vs. CCIPs

There are two primary approaches for arranging the insurance for a large project:

- Contractor-Controlled Insurance Program (CCIP): The general contractor is responsible for arranging the CAR/Builder’s Risk policy and any other necessary project-specific insurance.

- Pros for the Contractor: They control the process, can use their existing broker relationship, and may be able to secure better rates based on their overall business volume. They have direct access to the insurer in case of a claim.

- Cons for the Owner: They have less transparency into the coverage and must rely on the contractor to purchase an adequate policy. They may be paying for the insurance indirectly through the contract price markup.

- Owner-Controlled Insurance Program (OCIP): The project owner or developer purchases the insurance for the entire project, covering themselves, the general contractor, and all subcontractors under one master policy.

- Pros for the Owner: Complete control and transparency. They know exactly what coverage is in place. They can ensure the limits are adequate for their financial exposure. Potential for cost savings by eliminating contractor markups on insurance.

- Cons for the Contractor: They lose control and may be forced to work with an unfamiliar insurer. It can complicate their own corporate insurance program.

The choice between an OCIP and a CCIP depends on the project’s size, complexity, and the owner’s sophistication in risk management. For very large, multi-year projects, OCIPs are increasingly common.

How are Premiums Calculated?

There is no “flat rate” for Insurance of Works. The premium is a direct reflection of the risk. Insurers (known as underwriters) analyze many factors:

- Total Project Value (Total Contract Sum): This is the single biggest factor. The higher the value of the project, the higher the potential loss, and thus the higher the premium.

- Project Type and Complexity: Building a simple warehouse is less risky than building a high-tech hospital, a suspension bridge, or a tunnel. The materials used (wood-frame vs. steel and concrete) also play a huge role.

- Project Duration: A longer project means a longer period of exposure to risks like weather and theft.

- Location: Geographical risks are critical. A project in Florida’s “Hurricane Alley” or California’s earthquake zones will be far more expensive to insure than one in a benign Midwest location. Urban sites with close neighbors have higher liability risks than rural sites.

- Contractor’s Experience and Claims History: An experienced contractor with a proven track record and a clean safety record will get better rates than a new company or one with a history of claims.

- Deductibles: The amount the insured pays out-of-pocket for each claim. Higher deductibles lead to lower premiums. For large projects, deductibles can be substantial ($100,000 or more).

When Should Coverage Start and End?

- Start Date: The policy MUST be in place before the first delivery of materials to the site or the first day of work, whichever comes first. You are exposed to risk (like theft of materials from the site) even before construction begins.

- End Date: Coverage typically terminates upon the earliest of the following:

- The policy expiration date.

- The project is completed and handed over to the owner.

- The property is put to its intended use or occupied.

- The project is abandoned.

It’s crucial that the policy term is long enough to cover the entire construction period, including potential delays.

Part 5: The Claim Process – What Happens When Disaster Strikes?

A policy is only as good as its ability to pay a claim. If you experience a loss, a clear and prompt process is essential.

Step 1: Ensure Safety and Mitigate Further Loss.

Your first priority is the safety of all personnel. Secure the site. If possible and safe to do so, take reasonable steps to prevent the damage from getting worse (e.g., putting a tarp over an exposed section to prevent further water damage).

Step 2: Notify Your Insurer/Broker Immediately.

Policies have strict notification requirements. Do not delay. Call your insurance broker as soon as possible. They will guide you on the formal notification process. Prompt notice is a condition of the policy.

Step 3: Document Everything.

Before anything is moved or repaired (unless necessary for safety), document the scene thoroughly.

- Take hundreds of photos from every conceivable angle.

- Take videos, narrating what is being shown.

- Preserve any damaged equipment or materials that may be needed for inspection.

- Gather all relevant documents: daily reports, witness statements, weather reports, invoices for damaged materials.

Step 4: Cooperate with the Loss Adjuster.

The insurance company will appoint a loss adjuster (or claims adjuster) to investigate the claim. This is their expert who will assess the cause of the loss, the extent of the damage, and the amount payable under the policy. Be transparent, provide all requested documentation, and work with them.

Step 5: Quantify Your Loss and Settle the Claim.

You will need to assemble a detailed claim submission, including contractor estimates for repairs, invoices for replacement materials, and costs for labor. The loss adjuster will review this, and there will likely be a period of negotiation. Once an amount is agreed upon, the insurer will issue payment (less your deductible), allowing you to complete the repairs and finish the project.

Conclusion: The Financial Scaffolding of Your Project

Let’s return to our two projects. Project Atlas failed not because of a lack of skill or ambition, but because of a failure to see the whole picture of risk. Its creators insured their liability but left the multi-million dollar asset they were creating completely exposed.

Project Phoenix succeeded because its stakeholders understood that a construction project is a living, vulnerable entity. They protected it with a specialized policy designed for its unique lifecycle. The Insurance of Works was the unseen blueprint, the financial scaffolding that held the entire enterprise together when the physical structure failed.

Do not make the mistake of seeing this coverage as a mere line-item expense or a box to be checked for a lender. It is a strategic investment in certainty. It is the mechanism that transforms a potentially project-killing catastrophe into a manageable (and funded) problem. Before you break ground, before you order the first delivery of steel, sit down with an expert insurance broker and ensure that the most important part of your project—its ability to be completed—is fully protected.