Construction Insurance for Homeowners: Building or renovating a home is an exciting journey that promises comfort, personalization, and long-term value. However, it also involves considerable risks and financial commitments. One of the most important yet often overlooked aspects of this process is securing adequate construction insurance. This comprehensive guide explores everything homeowners need to know about construction insurance, helping you protect your investment from unforeseen events and ensuring peace of mind throughout your project.

Table of Contents

- What is Construction Insurance?

- Why Do Homeowners Need Construction Insurance?

- Types of Construction Insurance Policies for Homeowners

- Builder’s Risk Insurance

- General Liability Insurance

- Workers’ Compensation Insurance

- Home Warranty Insurance

- Equipment and Tools Coverage

- When to Purchase Construction Insurance

- How Much Does Construction Insurance Cost?

- Factors Affecting Construction Insurance Premiums

- How to Choose the Right Construction Insurance Policy

- Common Risks Covered by Construction Insurance

- What is Typically Not Covered?

- Filing a Claim: What Homeowners Need to Know

- Tips for Reducing Construction Insurance Costs

- Construction Insurance and Legal Compliance

- Frequently Asked Questions (FAQs)

- Conclusion

What is Construction Insurance?

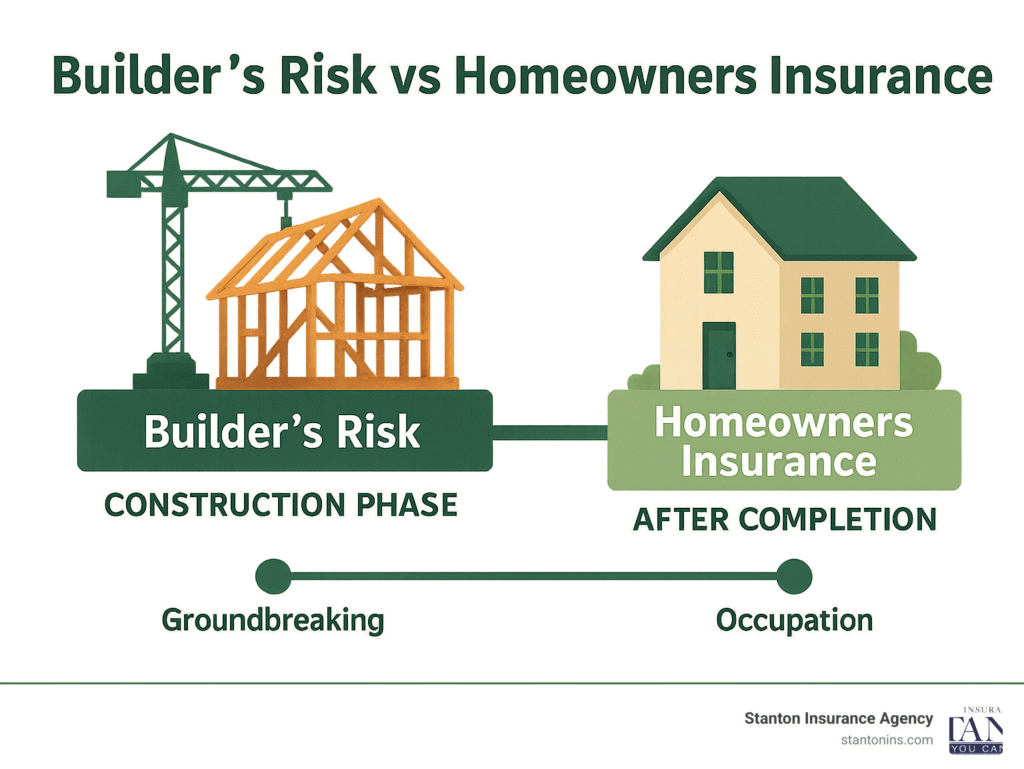

Construction insurance is a specialized form of insurance designed to cover various risks associated with building or renovating a home. It protects homeowners, contractors, and other stakeholders from financial losses due to damage, accidents, theft, or legal liability during the construction period. Unlike standard homeowner’s insurance, which covers finished properties, construction insurance focuses on the risks tied to the building process itself.

Why Do Homeowners Need Construction Insurance?

Construction projects are complex and involve numerous variables that can lead to unexpected problems. Without proper insurance, homeowners risk losing substantial amounts of money if something goes wrong. Construction insurance offers protection against:

- Property damage from fire, vandalism, or natural disasters

- Theft of building materials or equipment

- Injuries to workers or third parties on site

- Legal claims arising from accidents or negligence

- Financial losses due to project delays or contractor default

- Types of Construction Insurance Policies for Homeowners

Builder’s Risk Insurance

This is the cornerstone of construction insurance for homeowners. Builder’s risk insurance covers damage to the structure under construction, including materials, fixtures, and equipment. It typically protects against fire, wind, theft, vandalism, and certain natural disasters.

General Liability Insurance

This policy protects homeowners from liability claims resulting from injuries or property damage sustained by third parties during construction. It is essential when hiring independent contractors or subcontractors.

Workers’ Compensation Insurance

If you hire workers directly, workers’ compensation insurance covers medical expenses and lost wages if they are injured on the job. Some states require this insurance by law.

Home Warranty Insurance

This type of insurance provides coverage for defects in workmanship, materials, or systems after construction is complete. It offers long-term protection and reassurance for homeowners.

Equipment and Tools Coverage

Construction often requires expensive tools and machinery. This coverage protects against loss, theft, or damage to these items while on-site or in transit.

- When to Purchase Construction Insurance

Ideally, construction insurance should be purchased before any physical work begins. This timing ensures coverage from the moment materials arrive on site and work starts. If you wait until after construction has begun, you may be exposed to risks that are not covered retroactively. - How Much Does Construction Insurance Cost?

The cost of construction insurance varies widely based on factors such as project size, location, construction type, coverage limits, and deductible amounts. On average, homeowners might expect to pay between 1% and 5% of the total construction cost for adequate coverage. For example, a $300,000 renovation project might have insurance premiums ranging from $3,000 to $15,000. - Factors Affecting Construction Insurance Premiums

- Project Size and Value: Larger, more expensive projects carry higher risks and premiums.

- Location: Areas prone to natural disasters like floods, earthquakes, or hurricanes may have higher rates.

- Construction Type: Custom homes or projects involving unique materials can increase premiums.

- Contractor Experience: Licensed and insured contractors can lower risk and insurance costs.

- Coverage Limits and Deductibles: Higher limits and lower deductibles increase premiums.

- Security Measures: Use of security cameras, fencing, and on-site supervision can reduce premiums.

- How to Choose the Right Construction Insurance Policy

Start by assessing your project’s specific risks and needs. Consult with insurance agents who specialize in construction insurance. Compare multiple quotes and carefully review what each policy covers and excludes. Ensure that the policy includes sufficient liability coverage and protection for all project phases. - Common Risks Covered by Construction Insurance

- Fire and explosion

- Theft and vandalism

- Weather-related damage (windstorm, hail, lightning)

- Accidental damage during construction

- Injuries to workers or visitors

- Equipment breakdown or loss

What is Typically Not Covered?

- Damage resulting from poor workmanship or design errors

- Wear and tear or maintenance issues

- Delays caused by labor strikes or supplier problems

- Pre-existing damage before insurance was purchased

- Filing a Claim: What Homeowners Need to Know

In the event of a loss, notify your insurance company immediately. Document the damage with photos and keep all related receipts and contracts. Provide accurate and honest information during the claim process to avoid delays or denial. - Tips for Reducing Construction Insurance Costs

- Hire licensed and experienced contractors with insurance

- Implement strong site security measures

- Bundle insurance policies when possible

- Maintain clear communication with your insurer

- Review and adjust coverage as the project progresses

- Construction Insurance and Legal Compliance

Many states require proof of insurance before issuing building permits. Failing to secure appropriate construction insurance can result in fines, work stoppages, or legal liabilities. Always verify local regulations and ensure compliance before starting work. - Frequently Asked Questions (FAQs)

Q: Can my standard homeowner’s insurance cover construction work?

A: Typically, no. Standard policies exclude coverage for ongoing construction or major renovations.

Q: Does builder’s risk insurance cover contractor errors?

A: No, builder’s risk insurance generally does not cover faulty workmanship or design flaws.

Q: What happens if a worker is injured on my property?

A: If you hire workers directly, workers’ compensation insurance covers their medical expenses. If they are subcontractors, they should carry their own insurance.

Q: How long does construction insurance coverage last?

A: Coverage usually lasts for the duration of construction and may be extended during warranty periods.

Conclusion

Construction insurance is a vital safeguard for homeowners embarking on building or renovation projects. By understanding the types of coverage available, costs involved, and best practices for selecting policies, you can protect your investment and reduce financial risks. Taking the time to secure comprehensive construction insurance not only fulfills legal requirements but also provides invaluable peace of mind, allowing you to focus on creating your dream home with confidence. Always consult with qualified insurance professionals to tailor a policy that fits your unique project needs.

Invest wisely in construction insurance—because your home deserves the best protection from the ground up.