Construction Insurance Cost: Construction projects, whether residential, commercial, or infrastructure, involve significant financial investments, extensive planning, and multiple stakeholders. Managing risks effectively is crucial to ensure the success and profitability of any construction endeavor. One of the most vital tools for risk management in construction is insurance. Construction insurance provides financial protection against unforeseen events, accidents, damages, and liabilities that can disrupt or derail a project.

Understanding construction insurance cost is essential for contractors, developers, subcontractors, and project owners to plan budgets accurately and avoid unexpected expenditures. This comprehensive guide delves into the components, factors, types, and ways to optimize construction insurance cost, helping you make informed decisions and safeguard your investments.

Chapter 1: What Is Construction Insurance?

Construction insurance is a broad term encompassing various insurance policies designed to cover risks associated with construction activities. These policies protect against property damage, bodily injury, legal liabilities, equipment loss, and other losses directly or indirectly related to construction work.

Key types of construction insurance include:

- General Liability Insurance: Covers third-party bodily injury or property damage claims.

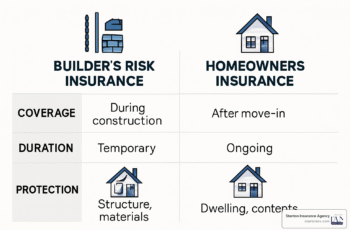

- Builder’s Risk Insurance: Protects the project property during construction against damage or loss.

- Workers’ Compensation Insurance: Covers medical expenses and lost wages for injured workers.

- Professional Liability Insurance: Also known as errors and omissions insurance, it protects against claims of negligence or faulty workmanship.

- Contractor’s Equipment Insurance: Covers loss or damage to construction equipment.

- Commercial Auto Insurance: For vehicles used in construction operations.

- Surety Bonds: Guarantee project completion or payment to subcontractors and suppliers.

Chapter 2: Why Is Construction Insurance Important?

The construction industry is inherently risky due to the complexity of projects, use of heavy machinery, hazardous working conditions, and multiple parties involved. Insurance mitigates these risks by transferring financial burdens to insurance companies. Without adequate coverage, a single accident or damage incident could lead to substantial financial losses, legal battles, or project delays.

Insurance also helps:

- Comply with legal and contractual requirements.

- Enhance credibility and trust with clients and partners.

- Secure financing, as lenders often require proof of insurance.

- Protect the workforce and assets.

- Manage cash flow by avoiding unexpected large expenses.

Chapter 3: Factors Influencing Construction Insurance Cost

Several variables affect the cost of construction insurance premiums. Understanding these factors can help you estimate potential expenses and find ways to reduce costs.

- Project Size and Value

Larger projects with higher budgets typically require higher coverage limits, resulting in increased premiums. The value of the construction project directly correlates with the amount of insurance needed to protect assets and liabilities.

- Type of Construction

The nature of the construction (residential, commercial, industrial) impacts risk levels. For instance, industrial projects may involve hazardous materials or complex systems, increasing risk and insurance costs.

- Project Duration

Longer projects expose insurers to prolonged risk periods, leading to higher insurance costs. Short-term projects usually have lower premiums.

- Location

Geographical location influences insurance costs due to varying regulations, weather risks (floods, earthquakes), crime rates, and labor market conditions.

- Coverage Limits and Deductibles

Higher coverage limits increase premiums, while higher deductibles can lower costs but increase out-of-pocket expenses during claims.

- Contractor Experience and Safety Record

Experienced contractors with a history of safe work practices, minimal claims, and proper training tend to receive lower premiums.

- Types of Coverage Needed

Selecting comprehensive coverage versus basic policies affects the overall cost. Additional endorsements or riders also add to premiums.

- Subcontractor Management

How well subcontractors are vetted and insured influences the general contractor’s insurance costs.

Chapter 4: Detailed Breakdown of Construction Insurance Costs

To better understand construction insurance cost, let’s examine average premium rates and typical expenses associated with each major insurance type.

- General Liability Insurance

- Average cost ranges from $400 to $1,500 annually per $1 million of coverage.

- Contractors often purchase $1 million to $2 million limits.

- Premiums depend on company size, project type, and claims history.

- Builder’s Risk Insurance

- Typically costs between 1% to 4% of the total construction value.

- Premiums vary based on project location, duration, and materials used.

- Covers damages due to fire, theft, vandalism, weather, and more.

- Workers’ Compensation Insurance

- Rates depend on payroll size and classification of work.

- Average cost can range from $0.75 to $2.74 per $100 of payroll.

- Higher-risk jobs (roofing, demolition) attract higher rates.

- Professional Liability Insurance

- Costs typically range from $1,000 to $5,000 annually.

- Premiums depend on firm size, project complexity, and coverage limits.

- Contractor’s Equipment Insurance

- Premiums are usually 1% to 6% of the equipment’s value annually.

- Covers repair or replacement of tools and machinery.

- Commercial Auto Insurance

- Costs vary based on the number of vehicles, usage, and driving records.

- Average premiums can range from $1,200 to $3,000 per vehicle annually.

- Surety Bonds

- Premiums generally range from 0.5% to 3% of the bond amount.

- Rates depend on creditworthiness and project risk.

Chapter 5: How to Estimate Your Construction Insurance Cost

Estimating construction insurance cost requires gathering specific project details and consulting with insurance professionals. Here is a step-by-step approach:

- Define Project Scope and Value

Determine total construction costs including labor, materials, equipment, and subcontractor expenses.

- Identify Required Insurance Types

Review contractual and legal requirements to decide necessary coverage types and limits.

- Assess Risk Profile

Consider project complexity, site conditions, workforce experience, and location risks.

- Request Quotes from Multiple Insurers

Provide detailed project information to insurance brokers or companies for accurate quotes.

- Analyze Premiums and Coverage Terms

Compare prices alongside coverage benefits, exclusions, and claims handling reputation.

- Adjust Coverage and Deductibles

Balance between premium costs and out-of-pocket risks.

Chapter 6: Tips to Reduce Construction Insurance Cost

Managing insurance expenses without compromising coverage is possible by implementing these strategies:

- Improve Safety Programs

Enhance workplace safety training, enforce rules, and reduce accident rates.

- Maintain Good Claims History

Promptly report and resolve claims to prevent premium hikes.

- Bundle Policies

Purchase multiple insurance policies from the same provider for discounts.

- Increase Deductibles

Accept higher deductibles to lower premium payments.

- Vet Subcontractors

Hire insured, reputable subcontractors to reduce liability.

- Choose Appropriate Coverage

Avoid unnecessary riders or excessive limits beyond project needs.

- Work with Experienced Brokers

Insurance brokers specializing in construction can find tailored and competitive options.

Chapter 7: Common Construction Insurance Challenges

Understanding potential hurdles helps prepare better risk management plans.

- Underinsurance: Inadequate coverage limits leading to financial exposure.

- Claim Denials: Misunderstandings about policy terms causing denied claims.

- Cost Volatility: Premium fluctuations due to market conditions or claims history.

- Compliance Issues: Failing to meet insurance requirements delaying projects.

- Coordination of Coverage: Overlaps or gaps between multiple policies.

Chapter 8: Case Studies and Real-World Examples

- Residential Development Project

A 50-unit housing development valued at $10 million required builder’s risk, general liability, and workers’ compensation insurance. By implementing strict safety protocols and hiring insured subcontractors, the developer reduced premiums by 15%, saving $30,000 annually.

- Commercial Office Construction

A $25 million office tower project faced high insurance costs due to location in a high-crime urban area. The contractor invested in on-site security and surveillance systems, which insurers recognized, resulting in a 10% premium reduction.

- Infrastructure Project

A bridge construction project with heavy equipment insured via contractor’s equipment insurance incurred a machinery theft. The insurance claim covered replacement costs, preventing project delays and financial loss.

Chapter 9: Future Trends Affecting Construction Insurance Cost

The construction insurance landscape is evolving due to technological, economic, and environmental factors:

- Increased use of drones and AI for risk assessment.

- Growing emphasis on sustainability and green building insurance considerations.

- Rising cyber insurance needs for data protection in construction management systems.

- Impact of climate change increasing natural disaster-related claims.

- Legislative changes influencing insurance mandates and coverage options.

Conclusion

Construction insurance cost is a critical component of overall project budgeting and risk management. By understanding the types of insurance, factors influencing premiums, and strategies to optimize costs, stakeholders can protect their projects, workers, and financial interests effectively. Engaging with knowledgeable insurance professionals, maintaining safety standards, and carefully selecting coverage ensures that your construction venture remains resilient against unforeseen challenges while controlling insurance expenses.

Remember, investing in the right insurance coverage is not just a regulatory requirement but a strategic decision that safeguards your business reputation and long-term success in the competitive construction industry.